ELITE ROBOT: Der europäische Cobot-Markt am Ende der Pandemie

Von ELITE ROBOT, dem aufstrebenden chinesischen Cobot-Startup, erhielt ich den Auftrag zur Darstellung des europäischen Marktes. Zugeich erhielt ich die Erlaubnis Auszüge an dieser Stelle zu veröffentlichen. Das Unternehmen strebt auf den hiesigen Markt und sucht Distributoren, Vertriebsprofis und Techniker. Interessenten möchten sich bitte die bereits in Portugal und Italien befindlichen Partner wenden (Link).

Besuchen Sie den Deutschen Robotikverband für mehr Informationen.

Die Pandemie scheint sich in Europa – je nach Risikobeurteilung – früher oder später ihrem Ende zu nähern. Zeit für einen Rückblick und zu überlegen, welche Auswirkungen die Pandemie auf die Robotik hatte.

Wirtschaftliche Entwicklung

Im ersten Jahr der Pandemie, also 2020, kam es zu einem starken Einbruch der Wirtschaftsleistung in allen europäischen Staaten. Hauptgrund hierfür war der Schock incl. Werksschließungen als Schutzmaßnahme und Lockdowns. 2021 erholte sich die Wirtschaft, wobei das vorherige Niveau noch nicht wieder erreicht wurde. Grund waren weitere Schließungen sowie auch der Materialmangel. Die Wirtschaft hat sich zwischenzeitlich erholt, liegt aber noch unter dem Niveau vor Beginn der Pandemie. Dies kann – vor allem in Deutschland – an den zuvor unbekannten Lieferengpässen liegen. In 2021 mußten diverse Autohersteller ihre Werke über Wochen schließen. Der deutsche Autohersteller VW produzierte an seinem Hauptstandort Wolfsburg so wenige Auto wie zuletzt vor über 60 Jahren. Von Lieferengpässen waren zwischenzeitlich zahlreiche Branchen betroffen. Die Stimmung an sich ist in den meisten Sektoren des verarbeitenden Gewerbes aber positiv.

Die für die Robotik relevanten Hauptbranchen sind teilweise sehr optimistisch gestimmt. Der Maschinenbau erwartet ein weiteres Spitzenjahr und sollte Ende 2022 mehr Umsatz als vor Corona erlöst haben. Hinzu kommt die Transformation der Fahrzeugindustrie mit entsprechend vielen Investitionen in neue Produktionsanlagen für die Elektromobilität incl. Batteriefertigung. Im Gegenzug gibt es kaum noch Investitionen in die Fertigung von Verbrennern. Dennoch, in der Kfz-Industrie besteht ein Cobot-Potential. Exemplarisch steht hierfür der Use-Case Fiat 500. Dessen Zusammenbau wird von 11 Cobots unterstützt. Dies auch deshalb, weil das Durchschnittsalter der Fiat-Arbeiter stetig steigt und damit die Ergonomie wichtiger wird (Link). Dies dürfte auf fast alle Automobilwerke Europas mit Ausnahme zutreffen.

Die Entwicklung des Bruttoinlandsproduktes wichtiger Länder kann dieser Tabelle entommen werden:

[table id=2 /]

Die Tabelle zeigt, dass Länder mit einem besonders starken Einbruch in 2020 in 2021 stärker wuchsen als die mit einem moderateren Einbruch. Wichtiger erscheint der Optimismus für 2022: Eine positive Wachstumserwartung ist aus zwei Gründen bedeutsam: Einerseits sind bei steigenden Erlöse leichter Preiserhöhungen umsetzbar so dass dann auch die Gewinne steigern und noch mehr kann eine positive Einschätzung als wichtigste Voraussetzung für Investitionen genannt werden. Die deutsche Staatsbank KfW hat im Oktober 2021 eine Umfrage über das Investitionsverhalten im Mittelstand veröffentlicht. 62% der Unternehmen weiten dann ihre Investitionen aus, wenn die Umsatzerwartung für das eigene Unternehmen positiv ist. Umgekehrt mindert 43% der Unternehmen ihre Investitionen bei sinkenden Erlösen.

China – ELITE ROBOT

Unser Bundespräsident Steinmeier sagte nach seiner Wiederwahl, der Westen habe die Pandemie am besten überstanden. Nun, er hat wohl nicht an China gedacht. Das Land hatte deutlich weniger Todesopfer als Deutschland oder die USA. Während Europa eine Zeit lang gelähmt war, herrschte in China weitgehend Normalität. Der Cobot-Hersteller ELITE ROBOT, Partner des Artikels, hat sogar eine neue große Produktionsstätte gebaut, seine Entwicklung intensiviert und eine weitere Finanzierungsrunde abgeschlossen. Da das Unternehmen kaum Zukauf-Teile verwendet, sind im Video mehr Mitarbeiter in der Fertigung als in anderen Unternehmen zu sehen.

Hat sich das Konsumverhalten durch die Pandemie geändert?

Seit Beginn der Pandemie gab es “Gewinner”- und “Verlierer”-Branchen. Zu den “Gewinnern” gehörten gerade 2020 alle Branchen, die Schutz und/ oder Unterhaltung des Einzelnen fördern. Hierzu gehören Freizeitbereiche wie Zweiräder (Fahrräder, auch mit Strom wie auch Motorräder), Wohnmobile oder Unterhaltungselektronik. Zu den Gewinnern zählten auch Bauzulieferer. Während des Lockdowns wurden die Heimwerker aktiv. Verloren haben hingegen Gastronomie und Kultur, die unter den häufig strengen Auflagen des Staates litten und noch immer leiden. Mal wurden sie ganz geschlossen, dann durften sie nur Geimpfte bedienen. Die Gastronomie wurde und wird zwar finanziell entschädigt, dürfte aber nachhaltig unter einem Exodus ihres Personal leiden. Die Pandemie hat gezeigt, dass Unternehmen selbst bei großer Personalnot und extremen Kapazitätsmangel kaum ihre Abläufe ändern: Gerade die Corona-Testlabore hatten sehr viel zu tun, automatisierten aber nicht.

Wie hat sich der europäische Cobot-Markt entwickelt?

Für die Robotik von Bedeutung war die Absage fast aller Messen und häufig auch die der Besuchstermine. Viele Unternehmer sehen erstmals auf einer Messe einen Cobot. Diese Möglichkeit des häufig zufälligen Anschauens entfiel. Unternehmen kaufen Cobots selten Online oder am Telefon. Sie wollen erstmal ihre Ansprechpartner kennenlernen und mehr über Robotik erfahren. Dazu wollen sie die Sicherheit, dass es eine genau für sie passende individuelle Lösung gibt. Dies war in 2020/ 21 zeitweise nur schwer möglich. Ebenfalls kaum möglich waren regionale Netzwerktreffen, bei denen sich Unternehmer untereinander austauschen. Nach der ersten Welle, die bis Ende Mai ging, kam ab Oktober 2020 zunehmend die zweite Welle. Mit ihr verbunden waren Besuchsverbote in Firmen bzw. letztlich die fehlende Bereitschaft neue Kontakte zu knüpfen. Messen fanden bis heute praktisch nicht mehr statt, allenfalls virtuell. Der Nutzen der virtuellen Messen war allerdings sehr begrenzt.

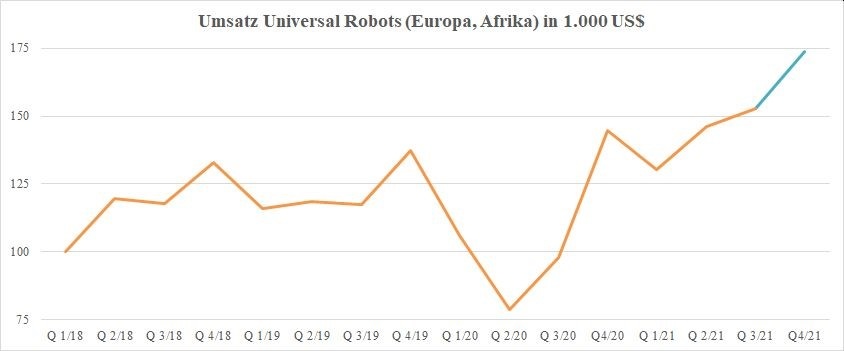

Insbesondere zu Beginn der Pandemie brach der Umsatz der Robotik massiv ein. Ab dem 3. Quartal 2020 verbesserte sich die Entwicklung maßgeblich und seitdem werden neue Umsatzrekorde erzielt. Die Zahlen des Marktführers sorgen hier für die nötige Transparenz (blaue Linie = Schätzung). Da sich sein Marktanteil in Europa kaum verändert haben dürfte, steht seine Entwicklung exemplarisch für die Cobot-Branche:

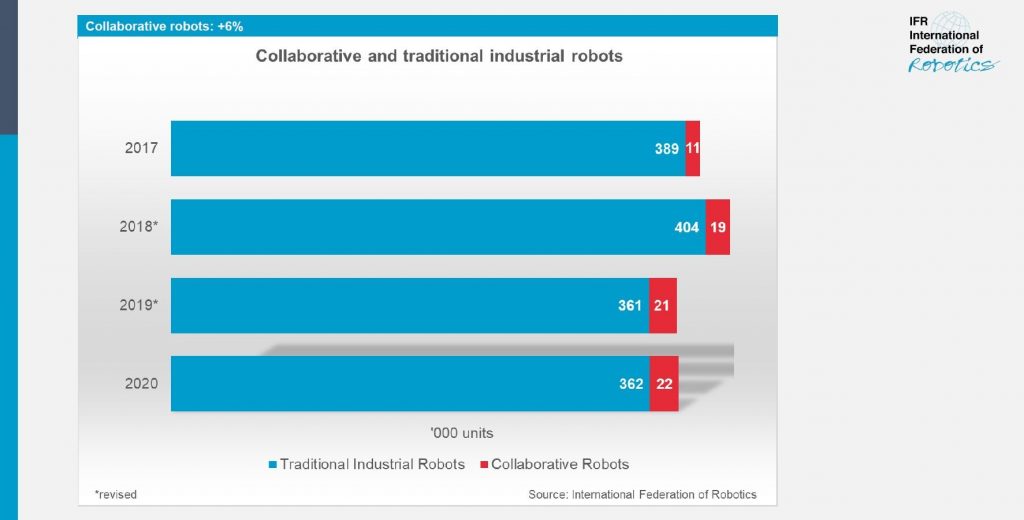

Relativ gesehen stagnierte 2020 weltweit die Bedeutung der Cobots, wie diese Graphik verdeutlicht:

2021 dürfte die Entwicklung deutlich positiver gewesen sein.

Entwicklung in Großbritannien

Zu Beginn der Pandemie kündigte der damals neue schottische Vertriebshändler von Universal Robots, SP Automation & Robotics, an, im ersten Jahr der Zusammenarbeit Cobots im Wert von 1 Million Pfund verkaufen zu wollen. Für ein Land mit einer Bevölkerung von nur 5,5 Millionen Einwohnern ist das eine beachtliche Summe. Da das Unternehmen in den letzten zwei Jahren fleißig Cobot-Videos hochgeladen hat, dürfte es recht erfolgreich gewesen sein. Das zeigt, dass ein etabliertes Unternehmen auch unter schwierigeren Umständen ein neues Produkt auf den Markt bringen kann.

WMH Transmissions, der Universal Robots-Händler mit dem größten Ausstellungsraum im Vereinigten Königreich, erwirtschaftet weniger als 6 Millionen Euro. Die vorläufigen Bilanzzahlen zeigen eine zuletzt stagnierende Entwicklung.

Insgesamt scheint die Entwicklung in Großbritannien also stabil gewesen zu sein. Im Gegensatz zu Deutschland scheint es im Vereinigten Königreich jedoch weniger Wettbewerb zu geben. Die in Deutschland gegründeten Unternehmen wie Franka Emika, Yuanda, Neura Robotics, Agile Robots oder RobCo sind nahezu unbekannt. Und Start-ups wie Kassow Robots scheinen im Vereinigten Königreich noch eine schwache Basis zu haben.

Portugal: Ein Land mit beachtlichem Marktanteil von ELITE ROBOT

Portugal scheint ein besonderes Land für die Robotik- und Cobot-Industrie zu sein. Einerseits leben in dem Land nur 10 Millionen Menschen und dann auch noch mit einer eigenen Sprache. Zum anderen gibt es in Portugal viele interessante produzierende Unternehmen, vor allem in der Elektronik und Feinmechanik.

Dazu kommt, dass der chinesische Cobot-Hersteller ELITE ROBOTS in Portugal einen sehr aktiven Partner hat. Über diesen wurde hier bereits berichtet.

Italien: AutomationWare hat stark in sein Cobot-Geschäft investiert

Der Automatisierungsspezialist AutomationWare (Venedig) ist während der Pandemie nicht in Schockstarre verfallen, sondern hat in neue Partnerschaften investiert. Zunächst wurde er Partner von ELITE ROBOTS, dem Partner dieses Artikels, und seit kurzem von Geek+. Im Video stellt Automationware den Cobot als Eigenentwicklung vor, ich gehe aber davon aus, dass es sich um einen ELITE ROBOTS handelt.

Globalisierte Robotik-Firmen ging es besser

In Deutschland gibt es neben einigen Roboterherstellern auch viele Zubehörfirmen. Schunk, Zimmer, Sensopart und viele andere sind jetzt mit verschiedenen chinesischen Marken kompatibel. Da ELITE ROBOT von Haus aus wie Universal Robots konfiguriert ist, konnten einige Hersteller ohne Umstellung vom stabileren chinesischen Markt profitieren.

Welche Roboter-Hersteller werden bevorzugt?

Vermutlich weil die Nachfrage nach Cobots in den einzelnen Ländern noch zu gering ist, gibt es keine detaillierte Aufschlüsselung nach Cobot-Herstellern und Ländern. Bemerkenswert erscheint aber, dass der Marktführer bei den Cobots, Universal Robots, häufiger genannt wird.

[table id=4 /]

Hohe Nachfrage kann bedient werden

Nun werden die Umsätze erzielt, die eigentlich bereits für 2019 erwartet worden waren. Erstaunlicher als die Umsatzentwicklung an sich erscheint die weitgehende Lieferfähigkeit in Zeiten des Chipmangels. Aus heutiger Sicht weisen in Europa Deutschland sowie Ost-Europa ein überdurchschnittliches Wachstumspotenzial auf. Hierbei ist zu berücksichtigen, dass nicht nur das erwartete Wachstum zählt, sondern auch die Ausgangsbasis. Die dürfte überall recht niedrig gewesen sein. Absolut gesehen dürfte das Potential in Osteuropa – und hier besonders in Polen – größer als in Italien sein. In Italien scheint das Gros der Cobots wiederum in Norden des Landes absetzbar zu sein. Wichtig erscheint auch der Hinweis, dass die Erhebung der nachfolgend gezeigten Daten vor dem Durchstarten der Elektromobilität und des Baus neuer Chip-Werke in Europa erfolgte. Gerade in Deutschland wird derzeit viel in die Batteriefertigung und auch weitere Chip-Werke investiert. D.h. das Wachstum hier kann nochmals höher ausfallen.

Die weiteren Aussichten für den Cobot-Absatz sind sehr gut. Von Bedeutung dürfte bei der Differenzierung nach Ländern auch die typische Industriestruktur in den Ländern sein. Gibt es ehr Gross- oder Kleinserien.

Komplettlösungen gewinnen an Bedeutung

Insbesondere Cobot-Neukunden begrüßen Komplettangebote. Im Idealfall verkauft ihnen ein Ansprechpartner eine komplette Arbeitsstation. Dies sorgt für Kostentransparenz, einen Ansprechpartner, ein geringeres Risiko und einfachere Abläufe an sich. Zu nennen sind vor allem komplette Schweißzellen, Palettierstationen und Bestückungsroboter. Für den Anbieter bietet dies die Möglichkeit der Skalierung, er muß nur einmal ein System aufeinander abstimmen. Die etwaige Feinabstimmung beim Kunden kostet weitaus weniger Zeit. Für den Cobot-Hersteller besteht somit auch die Möglichkeit der Skalierung, der Arbeitsentlastung, aber auch das Risiko der Auswechselbarkeit. Markenstarke Zellen-Anbieter nennen nicht einmal den Cobot-Hersteller. D.h. sie könnten ihn jederzeit austauschen.

Der vielleicht weltgrößte Werkzeughändler, die Hoffmann-Group, bietet eine Maschinenbestückung auf Basis eines Industrie-Roboters (Nachi) an, der aber auch nur 12 kg Traglast hat. Grund hierfür dürfte sein, dass auf Grund des Handlings mit schweren Teilen etc. ohnehin strenge Vorschriften gelten. Derzeit wird die Lösung, die es bereits ab 60.000 € incl. Flächenscanner und CE-Zertifizierung geben soll, nur im deutschsprachigen Raum angeboten.

Interessant auch, dass bei neuen Anbietern, die selber noch keinen Namen haben, der Cobot nicht in den Vordergrund gestellt wird. Kochboxen-Hersteller wie Aitme oder Davinci Kitchen werben zwar mit ihrer Technologie, nicht aber mit dem benutzten Cobot. Warum auch? Dem potentiellen Kunden wird der Cobot-Hersteller unbekannt sein.

Lediglich bei den Palettierrobotern scheint der Cobot-Hersteller ein Kaufkriterium zu sein. D.h. der Anbieter nennt i.d.R. den Namen des Robotik-Partners. Dies kann daraus resultieren, dass die Anbieter ebenfalls aus der Automatikbranche stammen und daher den potentiellen Kunden eben noch so vertraut sind wie beim Schweißen Demmeler, Lorch, Fronius, Heidenbluth etc.

Neue Anbieter

Während der Pandemie traten verstärkt Online-Plattformen auf. Ihr Entstehen dürfte aber unabhängig von der Pandemie erfolgt sein. Es war einfach an der Zeit. Denn unverändert werden Cobots oder Roboter nicht per Mausklick gekauft. Für einen Erstkontakt bietet ein guter Online-Auftritt incl. Preisangabe aber die Möglichkeit die Hemmschwelle zur Kontaktaufnahme zu reduzieren. Es gibt etwa eine handvoll Hersteller-unabhängige Online-Anbieter. Die Geschäftsmodelle unterscheiden sich hierbei:

- https://unchainedrobotics.de/ : Größter Marktplatz für Cobots (keine Industrieroboter), auch auf Englisch abrufbar. In Deutschland wird vor Ort auch verbaut.

- https://www.go2automation.de/ Führt Integratoren, Hersteller und Anwender zusammen (Vermittlung)

- https://coboworx.com/ : Das gut finanzierte Startup um den Ex-Fanuc-Europa-Chef Gehrels fing als Online-Integrator an und entwickelt mittlerweile selber preiswerte Industrieroboter, die in eigenen Stationen verbaut werden. Eine Palettierlösung bis 30 kg ist ab 2.800 €/ Monat verfügbar. Weitere Komplettlösungen befinden sich in der Pipeline.

Einzelne Roboter-Hersteller bieten selber Online an. Zu nennen sind ABB und igus, bei Doosan ist ein Integrator online.

Vernetzen wir uns? LinkedIn

-> Zur Cobot-Gruppe auf LinkedIn (Link)

In eigener Sache/ Werbung

Der Autor dieses Blogs ist maßgeblich am KI-/ Robotik-Projekt Opdra beteiligt. Er berät Robotik-Firmen und Investoren bei den Fragen Marktanalysen und Finanzierung/ Förderungen. Mehr zu seiner Person finden Sie hier.

Besuchen Sie den Deutschen Robotikverband für mehr Informationen.