IFR: > 500,000 robots installed worldwide for the first time in 2021

Finally, we have the new robotics statistics from the International Federation of Robotics.(Thanks to the IFR for all the graphs!) The number of robot installations worldwide rose 31% last year. The roughly 517,000 units installed were 22% higher than the pre-Corona record set in 2018. (Germany, by the way, is still below 2018 in terms of gross national product.) The 31% increase mentioned is interesting in that it confirms the hyper-proportional growth of cobots. Their market leader, the Danish company Universal Robots, could grow by about 40% in 2021, but probably lost market share in China. That is, the overall cobot market grew at a faster double-digit rate. Cobots grew by 50%, according to the graph.

Geographical distribution is unfavorable

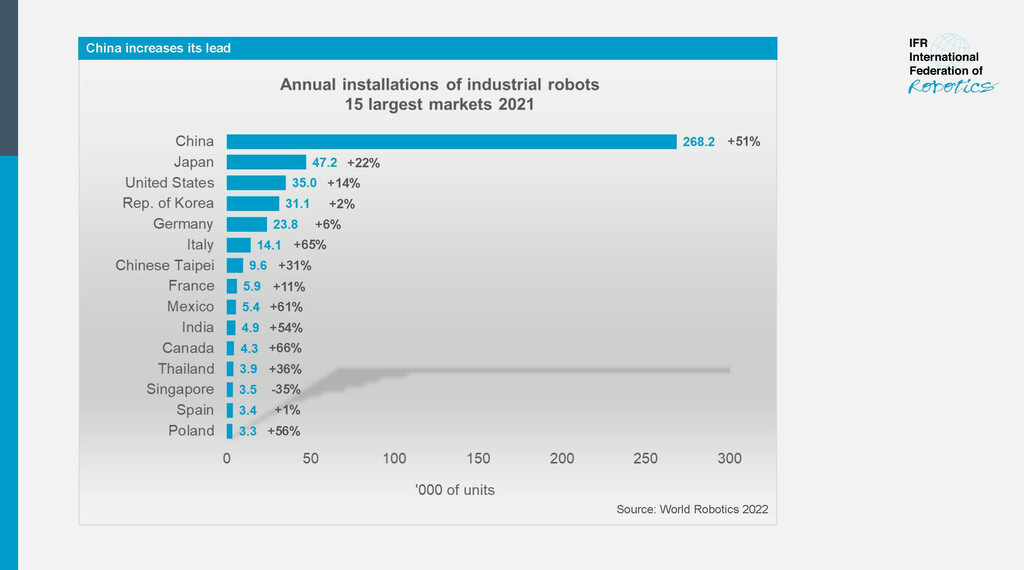

However, 74% (70%) of all robots were installed in Asia. For Western manufacturers, this means that if they are not represented there, they have a problem. In fact, half of all robots were launched in China (see also country graphs below).

Japan can hold its own as a production location

The second largest robot user, Japan, has produced the most robots. The construction of a new cobot production facility at FANUC alone should provide a further boost. I am somewhat irritated by the report that sales in Japan increased by 22& to 47,182 units, but the inventory only increased by 5% to 393,326. I.e. implies an average useful life of rather six or seven years and not more, as I would have thought. Japanese manufacturers in particular are known to value the very best quality.

Other sales markets

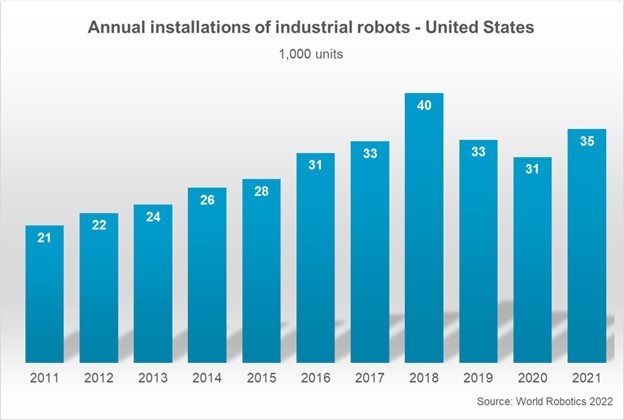

The third-largest sales market was again the USA, followed by South Korea. Measured against the large population, sales in the USA were downright low at 34,987 units. The pace of increase was limited at 14%. The peak of 40,373 units from the pre-Corona year 2018 was clearly missed.

South Korea is particularly interesting: after four years of declining installations, new deployments rose by only 2% in the year under review. Since there are also some newer cobot manufacturers here, competition in the country should be very tough. Sales of 31,083 units in this country suggest an average useful life of over 10 years. The inventory was a high 366,227 units.

Europe

Since most readers are primarily interested in Europe, the press release is adopted in detail:

Robot installations in Europe increased by 24% to 84,302 units in 2021. This figure marks a new high. Demand from the automotive industry remained constant, while demand from "General Industry" increased by 51 %. Germany, which is one of the five largest robot markets in the world, accounts for 28% of total European installations. It is followed by Italy with 17% and France with 7%.

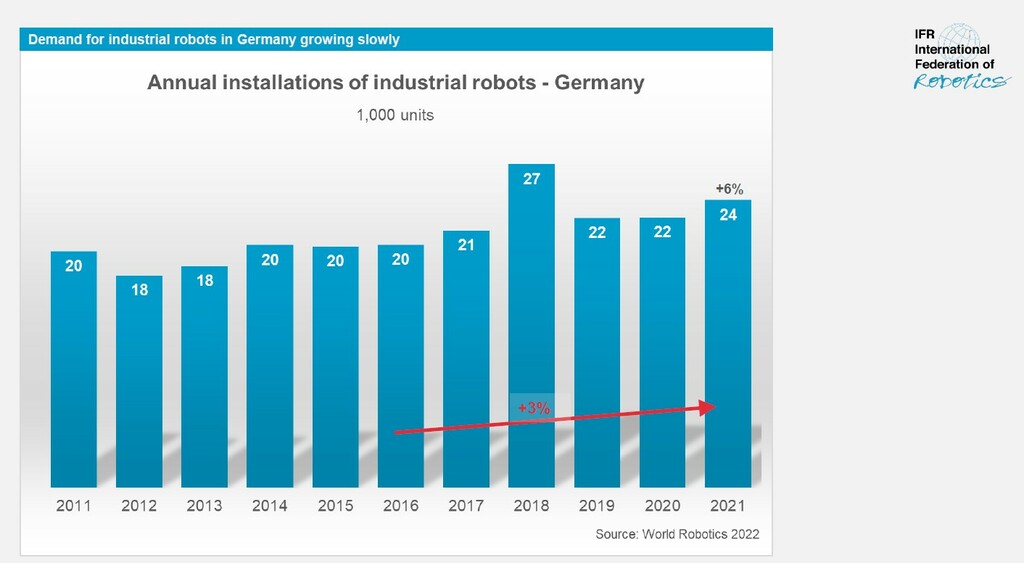

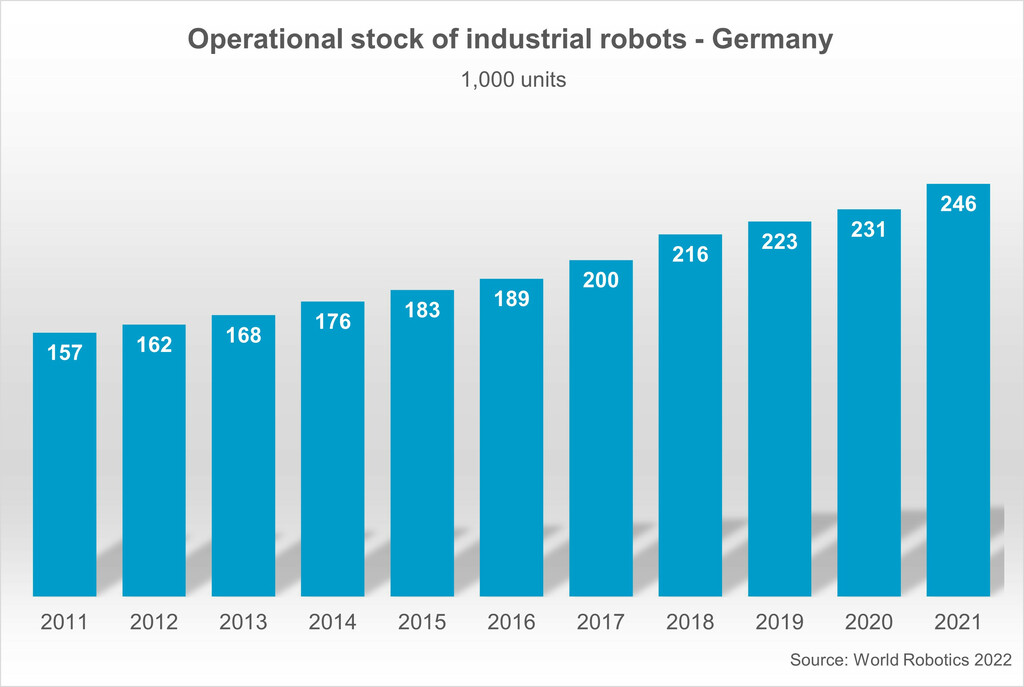

The number of installed robots in Germany increased by 6% to 23,777 units in 2021, which is the second-best ever result after the peak value from 2018 (26,723 units) - in this record year, the automotive industry had invested massively. The operational inventory of robots was calculated at 245,908 units (+7%) for 2021. Exports from Germany increased by 41% to 22,870 units, exceeding the pre-pandemic level.

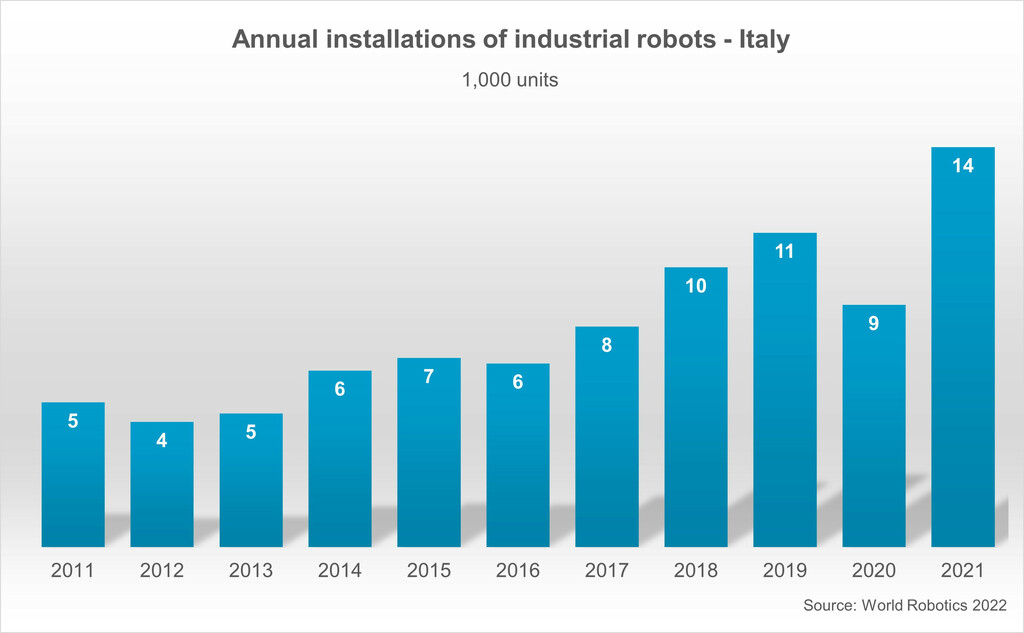

Italy is the second largest robotics market in Europe after Germany. The main growth driver between 2016 and 2021 was the "General Industry" with an average annual growth rate of 8%. The operational robot inventory was 89,330 units (+ 14 %). The 2021 results were impacted by catch-up effects and brought forward investments due to a reduction in tax credits in 2022. This led to a 65% increase in robot installations in 2021 to a new record level of 14,083 units.

The robotics market in France ranked third in Europe in 2021 in terms of annual installations and operating inventory, after Italy and Germany. Installations increased by 11% to 5,945 units. Operating inventory was calculated at 49,312 units for France. This represents a 10% increase over the previous year.

In the UK, installations decreased by 7% to 2,054 industrial robots in 2021. Operating inventory was calculated at 24,445 units (+6%). This compares to less than one-tenth of the inventory in Germany. The automotive industry in the UK reduced installations by 42% to 507 units in 2021.

Outlook

The association still expects sales of 570,000 units in the current year. The link contains further details. The VDMA expects a 10% increase in sales for its automation and robotics division this year. The recently forecast 14.7 billion euros would thus still be below the peak value from 2018 (15.1 billion euros).