voraus robotik statt Yuanda Robotics – Gespräch mit Jens Kotlarski

Dr. Jens Kotlarski ist in der Branche bestens bekannt und bedarf eigentlich keiner Vorstellung. Diese wird hier dennoch gegeben. Er gründete mit Partnern bereits 2012 die FORWARDttc GmbH – ein Unternehmen für Wissens- und Technologietransfer aus der Forschung in die Wirtschaft. Das Unternehmen wurde 2020 von der avateramedical GmbH übernommen. 2017 gründete Dr. Kotlarski die Yuanda Robotics GmbH mit Sitz in Hannover. Größter Gesellschafter war mit 70 % die chinesische Shenyang Yuanda Aluminium Industry Group, kurz Yuanda-Group genannt. Die Zusammenarbeit mit der Yuanda-Group war, so Dr. Kotlarski, stets vertrauensvoll und gut, Vereinbarungen wurden eingehalten. Insofern war die Yuanda Robotics GmbH nicht nur einer der ersten Cobot-Entwickler, sondern das erste deutsch-chinesische Robotik-Unternehmen überhaupt. In der Folge wurde mit dem „Yu“ ein auf KI-basierender Cobot mit zahlreichen interessanten Features (inkl. Integrierter Kamera und Bildverarbeitung) entwickelt. Hervorgehoben wurde auch stets sein User-Interface.

Besuchen Sie den Deutschen Robotikverband für mehr Informationen.

Diese Woche hatte ich die Gelegenheit zu einem Telefonat mit Dr. Jens Kotlarski, nun geschäftsführender Gesellschafter der voraus robotik GmbH, die letztlich aus der im Januar 2022 Insolvenz angemeldeten Yuanda Robotics GmbH hervorging.

Hintergründe der Insolvenz von Yuanda Robotics

In 2021 war der „Yu“ weitgehend marktreif. Die Yuanda-Group in ihrer Rolle als Hauptgesellschafter und Finanzinvestor, die einen zweistelligen Millionenbetrag investiert hatte, geriet allerdings – auch Corona-bedingt – in finanzielle Schwierigkeiten. Eine geplante Übernahme der Yuanda Robotics GmbH durch einen Dritten und in diesem Zusammenhang eine weitere Investition scheiterte allerdings überraschend in letzter Minute. Anfang 2022 wurde daher Insolvenz angemeldet. Durchaus mit Sanierungsfällen vertraut war ich vor dem Hintergrund der Insolvenz umso überraschter auf der automatica zu sehen, wie freudig und freundschaftlich Dr. Kotlarski von einem ehemaligen Mitarbeiter begrüßt wurde. Gemeinsam hatten sie das Vorhaben von der Idee bis zum Produktstadium getrieben. Aber 100 Meter vorm Ziel…

voraus robotik GmbH als Nachfolger der Yuanda Robotics GmbH

Die voraus robotik GmbH wurde als Nachfolge-Entität der Yuanda Robotics GmbH in der Insolvenz von Dr. Jens Kotlarski, Prof. Ortmaier (war schon bei Yuanda als Gründungsmitglied dabei) sowie der Bonanza Industrie GmbH gegründet. Diese wird von Philipp Georgi gehalten, der Dr. Kotlarski schon seit Jahren kennt und innerhalb der voraus robotik operativ tätig sein wird bzw. ist. Alle Gründungsmitglieder haben eigenes Kapital eingebracht. Dadurch ist die voraus robotik GmbH erstmal ausreichend finanziert, trotz der mit über 30 Personen hohen Mitarbeiterzahl. Anfang/Mitte 23 könnte eine Finanzierungsrunde anstehen.

Der deutsche Firmenname ist dem Umstand geschuldet, dass Jens Kotlarski den Ursprung des Unternehmens gerne nach außen trägt und stolz auf Herkunft und Firmensitz ist. Die niedersächsische Landesregierung wird dies gern zur Kenntnis nehmen, investiert sie doch ordentlich in das dortige Robotik-Cluster.

Die voraus robotik GmbH hat sämtliche Assets und IPs aus der Insolvenzmasse übernommen. Genauso wichtig war die Übernahme aller Entwickler.

Das Geschäftsmodell

Anders als zuvor sollen die Erlöse nun ausschließlich mit Software generiert werden. Da man aus der Mechatronik kommt und einen kollaborativen Roboter von der Idee bis zur Marktreife getrieben hat, wisse man, wie ein Roboter funktioniert, was ein modernes System leisten kann und welche besonderen Anforderungen an die Software und die unterstützen Technologien gestellt werden.

Jens Kotlarski meint, dass in den letzten Jahren die Industrierobotik ein wenig vernachlässigt wurde, da der Fokus aufgrund des prognostizierten Wachstums den Cobots galt. Dies soll mit seiner Software ausgeglichen werden können. Industrieroboter seien viel robuster als Cobots, von der Software aber eher „mittelalterlich, wie ein Wikinger“. Den „muskulösen Maschinen soll nun die Intelligenz, Flexibilität und Usability moderner Cobots gegeben werden“.

Man will auf Basis der bisher entwickelten Software die bestehenden Betriebssysteme verbessern (s. u.). Sie können upgegradet oder auch vollständig ersetzt werden. Um zu testen ob dies überhaupt möglich ist, wurden im Frühjahr binnen sechs Wochen sechs verschiedene Roboter vollständig mit der existierenden Software zum Laufen gebracht. D. h. es konnten nach heutigem Technikverständnis nicht mehr aktuelle Systeme auf den aktuellen Stand der Entwicklung gebracht und so neue Funktionen, wie Bildverarbeitung, Machine Learning, Cloud-Konnektivität, umschlossen durch ein modernes User-Interface, implementiert werden. Dies aber eben mit der eigenen Software, statt der des Herstellers. Von Vorteil war hier die hohe Flexibilität und Modularität des Yus und seiner Software. Beispielsweise spielt das Kommunikationsprotokoll keine Rolle. Als weiteres Beispiel muss die oder generell eine Kamera nicht notwendigerweise am Roboter montiert sein, sondern kann auch ganz woanders verortet sein oder sogar gänzlich ohne robotischen Zusammenhang fungieren. Die Modularität gilt gleichermaßen für die Safety. Sie ist dezidiert mit einem eigenem Controller, so dass die komplette Robotik-Überwachung normgerecht stattfinden kann. Letztlich soll so Unternehmen die Möglichkeit gegeben werden in kürzester Zeit die Lücke zu solch innovativen Firmen, wie z. B. Neura Robotics, (größtenteils) zu schließen oder auch Lieferschwierigkeiten auszugleichen. Denn der Ansatz ist aufgrund seiner Hardwareagnostik auch zum schnellen Komponentenwechsel, bspw. auf Steeuerungsebene, geeignet.

Für die Roboterhersteller und generell für die Kunden von Bedeutung ist, dass sie exklusiven Zugriff auf ihr spezifisches Domainen-/Fachwissen behalten. Durch eine eigens entwickelte API und Entwicklungsumgebung kann „jeder sein Ding machen“, eigene Applikationen durch Integration von Domainen/-Fachwissen realisieren, um das Versprechen von Turnkey-Solutions und applikationsspezifischen Lösungen wirtschaftlich einzuhalten.

Jens Kotlarski ist der von mir geteilten Ansicht, dass Turnkey-Solutions immer mehr nachgefragt werden. Der Kunde will eine fertige Lösung und keine Puzzle-Teile. Mittels der voraus robotik-Software können die Lösungen leichter und völlig flexibel erstellt und auf den richtigen Systemen oder Systemverbunden ausgeführt werden.

Zielkunden

Die Software wird derzeit Roboterherstellern, OEMs und großen Integratoren angeboten. In dem Zusammenhang ist auch eine Internet-Plattform im Entstehen, so dass auch Endanwender direkt verschiedene Apps nutzen können. Das vorhandene System und seine Funktionen können so auf die jeweilige Applikation flexibel maßgeschneidert werden. Man ist noch bei der Preisfindung, doch erscheint denkbar, dass die kleinste Version womöglich im oberen dreistelligen Bereich liegen wird. Die umfangreicheren Versionen und Technologiepakete dürften einen kleinen vierstelligen Betrag kosten.

voraus robotik bietet Unterstützung bei der Integration an. Eine individuelle Anpassung wird geboten. Dies erfolgt auch „um das Eis zu brechen“ und um die Software final noch einmal perfekt auf die vorhandene Hardware abzustimmen. Üblicherweise müssen nur Kleinigkeiten geändert werden. Nach 3-6 Monaten ist das vollständige Upgrade eines Betriebssystems möglich und das System ist marktreif. Mittelfristig soll so eine Marke und ein „Gütesiegel“ ähnlich wie „Intel inside“ aufgebaut werden.

Ich danke Dr. Jens Kotarski für das Gespräch, dessen Inhalt abgestimmt wiedergegeben wurde.

Gedanken des Autors

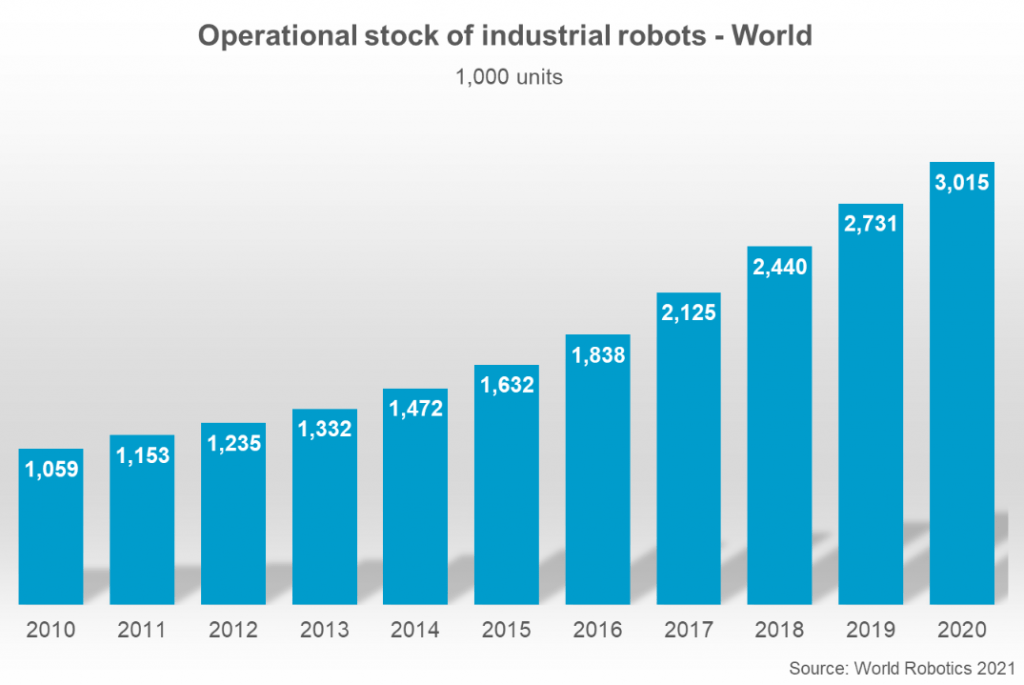

Nach meiner Einschätzung dürfte es bis Jahresende 2022 etwa 4 Mio. Industrieroboter weltweit geben. Ich denke, die neueren Roboter stehen erstmal an ihrem Arbeitsplatz, für den sie gedacht wurden. Ob noch in ganz alte Modelle investiert wird, ist eine interessante Frage. Im Sinne der Nachhaltigkeit wäre es sinnvoll.

Es wird spannend zu sehen, ob sich die Hersteller für ein Upgrade ihrer älteren Modelle noch interessieren oder nur noch in neuen Modellen denken. Unabhängig hiervor dürfte mittelfristig der Markt der Endnutzer sehr interessant sein. Die Software kann zugleich ein Verkaufsargument für neue Roboter sein, die noch nicht alles bieten: „Wenn es doch mal relevant wird, können Sie nachrüsten.“

Vielleicht umfasst der Kernmarkt von voraus robotik die Auslieferungen der Jahre (grob) 2014-2019. Die Gesellschafter von voraus robotik und vor allem Jens Kotlarski werden dies aber natürlich besser einschätzen können.

Vernetzen wir uns? LinkedIn

-> Zur Cobot-Gruppe auf LinkedIn (Link) .

In eigener Sache/ Werbung

Der Autor dieses Blogs ist maßgeblich am KI-/ Robotik-Projekt Opdra beteiligt. Er berät bei fast allen Fragen rund um Robotik incl Finanzierung/ Förderungen, aber nicht vertiefend in die Technik gehend. Mehr zu seiner Person finden Sie hier.

Besuchen Sie den Deutschen Robotikverband für mehr Informationen.